Shale Is Just a Scapegoat for Weaker Oil Prices

Shale Is Just a Scapegoat for Weaker Oil Prices

|

| Shale Is Just a Scapegoat for Weaker Oil Prices |

At the point when the Organization of the Petroleum Exporting Countries assembles in Vienna this week, individuals and non-OPEC oil makers are probably going to expand the generation cuts set up in November as an approach to shore up costs, which have been rough this month. Whatever the last points of interest resemble, a blend of oil-bullish strategy and jawboning are probably going to be on the menu.

Oil costs have ascended on pattern since April 2016, yet went under weight toward the beginning of May, and investigators at the end of the day indicated U.S. shale oil creation as the offender. And keeping in mind that shale is a major ordeal, there wasn't a noteworthy change in yield that set off the huge oil advertise selloff beginning May 2. All things considered, the shale story has been playing out for quite a while, and oil fix numbers are up around 125 percent since May 2016.

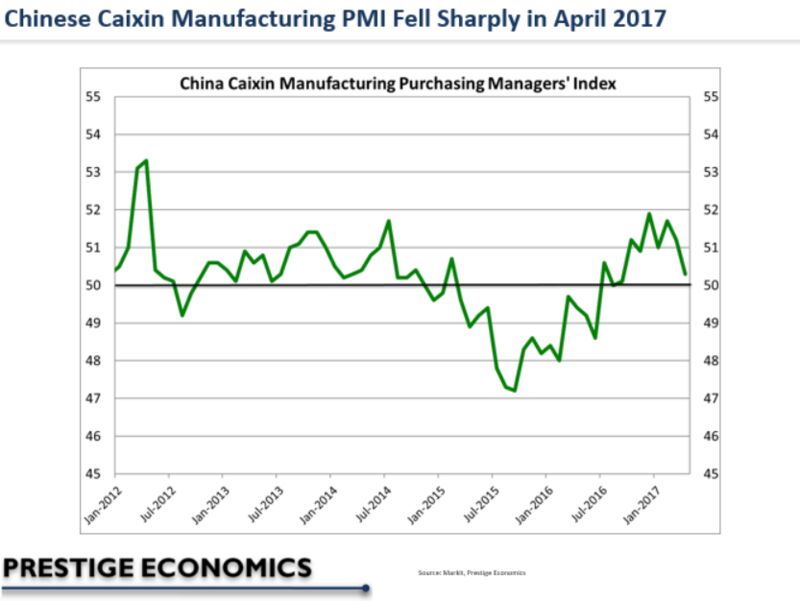

The emphasis on the supply side of the market to clarify this current selloff was misinformed on the grounds that this time, it was request that incited concerns: The April Chinese Manufacturing Caixin PMI, which was discharged late on May 1, tumbled to the slowest pace in seven months.

A lot is on the line and dealers won't have any desire to be steamrolled by an OPEC choice intended to bolster oil costs. This sets up oil costs up for moves higher, particularly since the OPEC posse and non-OPEC oil makers have all gotten in agreement. Their choice this week will be essential in light of the fact that these 25 nations represent more than 55 percent of worldwide oil creation. Be that as it may, there is an open deliberation over augmenting their oil creation cuts.

The Saudis have borne the brunt up until now, and some question to what extent they would make such a relinquish. To begin with, regardless of the possibility that they miss out on close term oil income from offering less barrels, they are not losing the oil, which they could in any case offer later on - and likely at a higher cost once worldwide oil showcase supply, request and stock flow have rebalanced.

In addition, the individuals who think the kingdom won't hold the line are disregarding one basic actuality: Saudi Aramco is preparing for a first sale of stock. By diminishing creation to bolster oil costs, the Saudis are making a figured wager that consistently organizes asset report over pay proclamation. Yielding some present income to bolster oil costs in front of its IPO could help the valuation of the whole organization - and of the offers available to be purchased. Any corporate official in the ware world would eagerly yield here and now pay misfortunes as an approach to altogether enhance an organization's monetary record in front of an IPO. What's more, Saudi Aramco's worth originates from oil, which will probably be estimated perceptibly higher at the season of the IPO than it is currently.

The current week's meeting of OPEC and non-OPEC oil makers will attract consideration regarding a reasonable cost bullish supply story for oil. Be that as it may, one week from now, merchants will again turn their regard for worldwide oil request essentials. At the highest priority on the rundown will be the May Chinese Caixin fabricating PMI, which will be discharged on the night of May 31 in the U.S. Chinese assembling is a solid intermediary for the pace of China's financial development, Chinese oil request development, and worldwide development. In that capacity, a decrease of the Caixin PMI beneath 50 would speak to a constriction in month to month Chinese assembling movement - and it could suggest slower worldwide monetary and oil request development. That would be bearish at unrefined petroleum costs in the close term, paying little heed to the OPEC approach choice this week.

Regardless of the possibility that the May Chinese PMI falls underneath 50, expect a pattern of month to month Chinese assembling extensions to go with a feasible unobtrusive speeding up of worldwide development throughout the following two years. This ought to bolster oil request development - and costs - on pattern, particularly if OPEC and non-OPEC oil makers get control over creation at the meeting on May 25 to permit the worldwide oil advertise more opportunity to rebalance worldwide oil free market activity.

Loading...

No comments